Every few months a broad range of articles arise from different sources across the internet decrying Bitcoin’s energy use. This isn’t new and will continue to happen for the entirety of Bitcoin’s existence. This sentiment isn’t new to Bitcoin which is just the newest incarnation of revolutionary technology. Overtime we’ve seen this type of energy fear-mongering being applied many times to new technologies such as the electrical grid, modern transportation, and the internet. Bitcoin is just this mental frame’s latest bad guy.

This perpetual concern isn’t unwarranted either. There is always a place for concern and diligence about how and why we use energy resources. The Bitcoin network commands a lot of resources and it is par for the course for people to take notice and ask the question, is this worth it?

What are the numbers?

Diving into Bitcoin metrics on a number of different issues is quite daunting given its newness, foreignness, the raw amount of data, and its highly public while simultaneously highly private nature. Detailing how much energy the Bitcoin network actually consumes is quite the beast of a task.

From my research there are two often quoted and reported analyses of Bitcoin energy consumption in the most recent influx of media articles. The two analyses are done by Alex de Vries of Digiconimist and the other is done by Marc Bevand an independent researcher. I mention each of these because of their thoroughness, frequency of appearance in media, differing methodologies, and mutual recognition and criticism of the other.

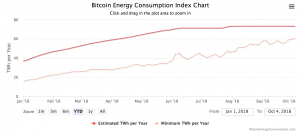

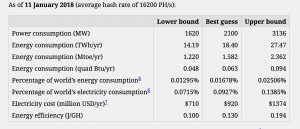

De Vries created the Bitcoin Energy Consumption Index (BECI) out of his analysis and his research has since been published in a peer reviewed journal, Joule, which is focused on energy related topics. During January 2018 according to the BECI the Bitcoin network was consuming electricity at a rate of about 20-40 Terawatt hours(TWh)/per year and has grown to the current rate of 60-70 TWh/per year.

According to Marc Bevand’s analysis the Bitcoin network was consuming electricity at a rate of about 14-27 TWh per year during January 2018.

Bevand’s has not updated his model to include the present moment but De Vries’ BECI seems to be alive and dynamic. We would expect Bevand’s model to indicate increased electricity consumption but for its estimate to be considerably less than the BECI estimate.

De Vries uses a high level economic analysis which starts off by estimating mining revenues and derives the network’s electricity consumption based on the expected costs of earning those revenues. Bevand does a more low level engineering and market analysis of the different mining rigs on the market. He details their efficiency and their market penetration and builds up from there to get an idea of the network’s electricity consumption. I can’t comment on the efficacy of either methods but both have pointed criticisms of the other. I’ll leave it up to the reader to determine which approach they see as more credible.

Having said that, it’s hard to tell the meaning of the numbers calculating electricity usage of the Bitcoin network unless we compare it to other things in the world. This is where the discussion gets interesting. Depending on the frame of reference given and your knowledge on the subject, Bitcoin can seem like an energy hog destined to swallow the world or something fairly innocuous that will compete in the market for energy like any other system.

Regardless of which analysis you prefer, De Vries’ or Bevand’s, Bitcoin currently consumes as much electricity at a similar rate as some small countries. This is no doubt a non-negligible amount of electricity but when we put this amount in the broader context of global electricity usage, Bitcoin is a small fraction of a percent of global electricity usage. The United States and China by themselves consume anywhere from 8,000-9,000 TWh per year. Even if we take the top of De Vries’ estimate of 90 TWh per year as the current rate of Bitcoin electricity consumption it only registers as 0.1% of the electricity consumption of just the US and China. Keep in mind we’re comparing electricity consumption which is just one part of the global energy picture. The media often conflates energy usage and electricity usage. The numbers look even better for non-alarmists if we compare Bitcoin’s energy usage to global energy consumption.

Depending on your frame you get wildly different impressions. A headline that is shocking and worrisome is much more likely to be read than an equivalently correct but innocuous headline. We can see why running with a headline like “Bitcoin uses more electricity than Iceland” would be put out by a “reputable” publication rather than “Bitcoin uses a fraction of a percent of global electricity”.

However, just because Bitcoin is a very small fraction of global electricity usage worldwide now doesn’t mean it will stay at that level for ever. If Bitcoin continues to grow in usage and value as many of us think it will we could see Bitcoin swallow up more and more of the global electrical grid’s output conceivably pushing it into a couple percentage points of global electricity usage.

Is this potential outrageous or totally worth it? To answer this we need understand what that electricity is being consumed for. Meaning we need to understand what proof of work is, why it’s there, and what it enables.

Proof of Work: Security and Consensus

Proof of work is pretty boring. It isn’t computers solving complex math problems as it is often described but rather computers guessing answers as fast as they can.

Hashing functions such as SHA-256(developed by the NSA) are used in Bitcoin mining because the results or output of a hash cannot be determined beforehand and specific answers cannot be targeted. This property forces miners to randomly guess trillions of times which requires a lot of energy. There is no gaming SHA-256. The work must be done by brute force which requires energy.

So why is this done?

We should first put to bed the repeated claim that proof of work mining is used to process transactions. The actual processing of transactions in the Bitcoin network is close to energy irrelevant. The number of transactions in a block have nothing to do with the amount of work needed to produce a valid block.

We really have to look no further than the Bitcoin whitepaper to understand why proof of work was implemented into Satoshi’s protocol and what purpose it serves. Its quite amazing how the source material is there for everyone to see yet goes unexamined or is blatantly misunderstood.

Satoshi needed a distributed network of untrusted parties to agree on the order of transactions that would take place on the network. To add a block of transactions to the Bitcoin blockchain the protocol requires a hash to be produced that could only be produced in ten minutes by a certain amount of hashing power. The amount of power required to produce the hash is supposed to be roughly equal to the amount of hashing power currently on the Bitcoin network. This hash is a proof of work of not only the individual miner but proof of work for the network as a whole. Since the hashing contest is a game of randomness and the difficulty of producing the hash equals the collective hashing power of the network the whole network needs to collectively compete for at least one of them to produce the right hash with the appropriate proof of work. Team work makes the dream work.

Each proof of work hash acts as a shield that protects the current block of transactions and the chain of transactions that precede it. The transactions inside each block cannot be altered without redoing the proof of work of that block and the proof of work of all the blocks that come after. Redoing the proof of work necessary to change the recorded history of transactions requires a substantial amount of computational energy. Malicious actors are forced to consume a considerable amount of resources to change the order of transactions.

The record of transactions are in effect protected by a great wall of energy. This wall of energy is added to every ten minutes by the collective hashing power of the Bitcoin network. Bitcoin’s hashing power works to protect the exact order of transactions that have been attested to by the Bitcoin network. This great wall of energy is what gives Bitcoin its data integrity and its coveted immutability.

In addition this great wall of proof of work acts as a signal to everyone on the network which chain of transactions were agreed upon as valid by the majority of the network’s hashing power. Miners are free to ignore the majority hashing power but their block of transactions won’t be added to the economic history of Bitcoin and they won’t be rewarded for their work. Proof of work is an objective, expensive, and unforgeable signal to produce but easy to check and keeps the network in agreement about the history and state of the network. Satoshi wanted to use the hashing power that protected the order of transactions as a mechanism for consensus amongst a distributed network in which no one party was to be singularly trusted. What would be trusted would be the objectivity and unforgeability provided by proof of work.

What we learn from Satoshi’s whitepaper is that proof of work was implemented to secure the economic history of the Bitcoin network and to build consensus around that economic history. It was a remarkable feat to solve the double spend problem without the need for a central administrator being trusted to monitor and govern the network. Proof of work is at the heart of what makes security and consensus possible.

This fact is important to understand when reading extrapolations about Bitcoin’s future energy consumption and what frame gives one the proper context of Bitcoin’s energy consumption. Linear projections of energy use based on transactions show that the writer either doesn’t know or is being disingenuous about the purpose and potential reasons for the growth of Bitcoin’s energy consumption. This usually leads many to make comparisons to Bitcoin’s energy usage to PayPal, Visa, and other payment processors because they use transactions as the focal point for understanding and comparison. While processing transactions is a part of the utility of Bitcoin it is a small (t)ruth. Focusing narrowly on transactions often excludes the larger (T)ruth that Bitcoin is a monetary AND payment system. Not including its moneyness and focusing exclusively on its payment system misses the larger picture. Including Gold mining, or the energy costs to maintain the US Dollar system(US military expenditure; geopolitical link between Dollars and oil) with the energy cost of payment processors would give a more complete and less alarming picture.

Conclusion

Bitcoin is a new monetary and payment system that gives the entire world an alternative to the existing financial system dominated by nation states and multinational banks. These entities control money, its creation, the record of monetary transactions, and their flows which are at the core of our global socio-economic system.

Bitcoin enables a new system to be constructed, outside the clutches of the status quo, with its own principles and capabilities. After all the debt fueled financial bubbles, bailouts, military interventions, and hyperinflation events experienced over the last century by populations all over the globe we think it’s more than worth it to build a new monetary foundation for those that want an alternative.

Proof of work is an essential part of the security of Bitcoin and its consensus mechanism. Its global energy footprint is small but not inconsequential. Anything as transformative and ambitious as the Bitcoin project will require energy. There is no getting around that. Energy is the currency of the universe. Nothing happens without a flow of energy. Bitcoin taps into this truism explicitly, harnesses energy and transforms it into a pillar on which its security and operation depends.

Proof of work is anything but wasteful, it’s essential.